Last Wednesday CROWDESTOR Head of SME Artur Geisari have hosted a live event dedicated to the credit report. CROWDESTOR is proud to offer its investors transparency, where we not only show how we analyze the SME borrowers but also what commissions we are charging along the way. Below you can find seven important questions that describe the SME Credit Report in detail.

1. What bond market has to do with it?

A credit report essentially brings investors clarity about the risk of the loan deal placed on the CROWDESTOR investment platform. Does high risk mean it is better not to invest, and you probably will lose money? This is not how it works, and a good example can be found in the bond market.

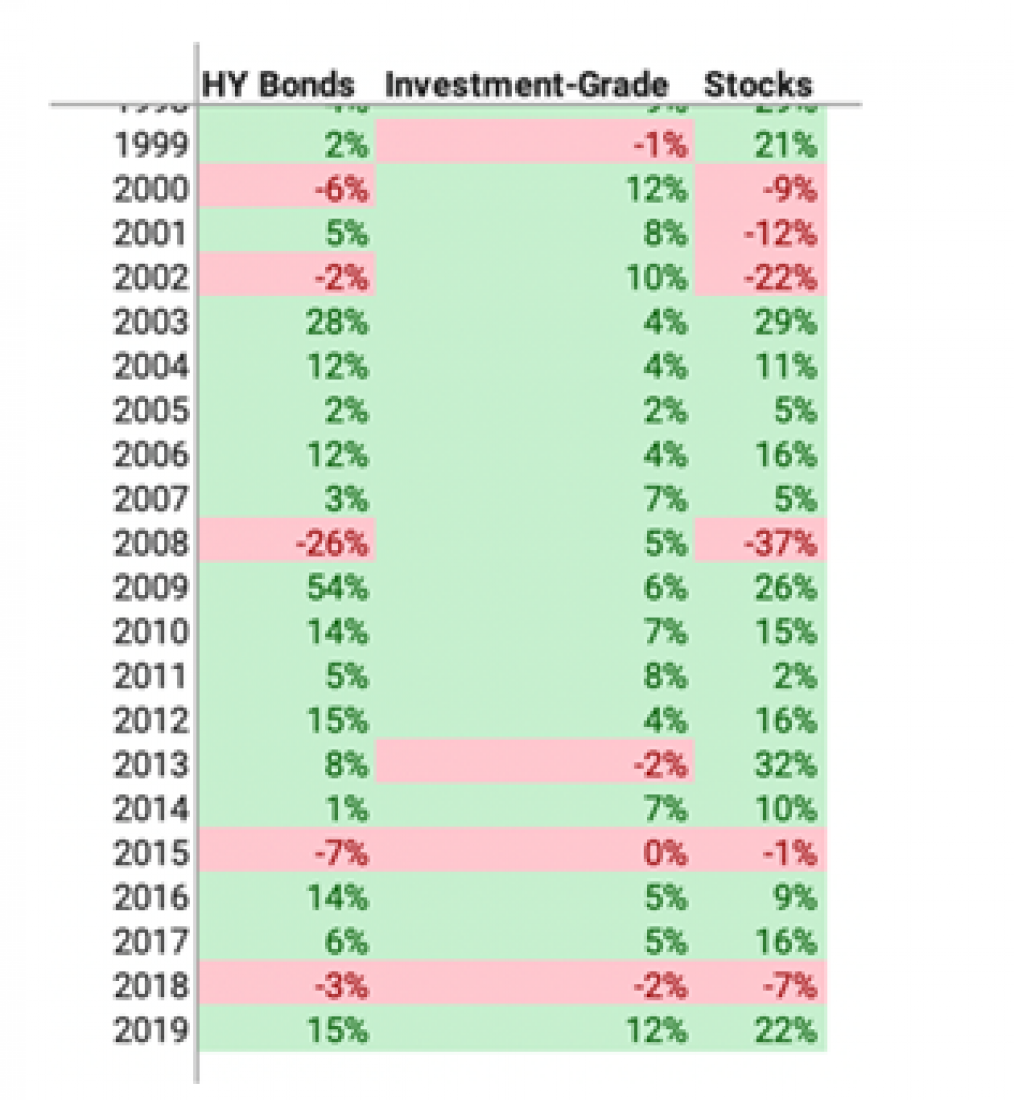

High yield (HY) bonds (or junk bonds) are much riskier than A-graded bonds, and historically are yielding more. Sure, the investor is taking on the risk, which he or she is compensated for. However, the historical data (Table 1) show that HY Bonds experienced an annual negative return (shown in red) five times during the past 20 years. This is only one year more than the investment-grade bonds, and even fewer times than the stock market.

Table 1:

Source: Balance: historical HY Bond Performance

Moreover, the loss in 2008 was compensated and rewarded in 2009. This means that the time factor is also important when looking at risky investments. What may be a gamble in the short term, in the long term will bring a positive return that has a much higher chance.

To sum up: the low credit rating does not mean you are likely to lose money, it means the risk is much higher and the real probability of default or delay will be visible once sufficient time passes. Also, it is important to bear in mind that the life span of the SME loan deal is much shorter than of the bond investment, so please take this into account when making an investment decision.

2. What is investing in SME?

In order to understand the credit report, it is important to understand what the product is first. The product is the business loan issued to the established company for the sum between 10,000 Eur-200,000 Eur, for a period between 3 to 18 months, secured with a personal guarantee.

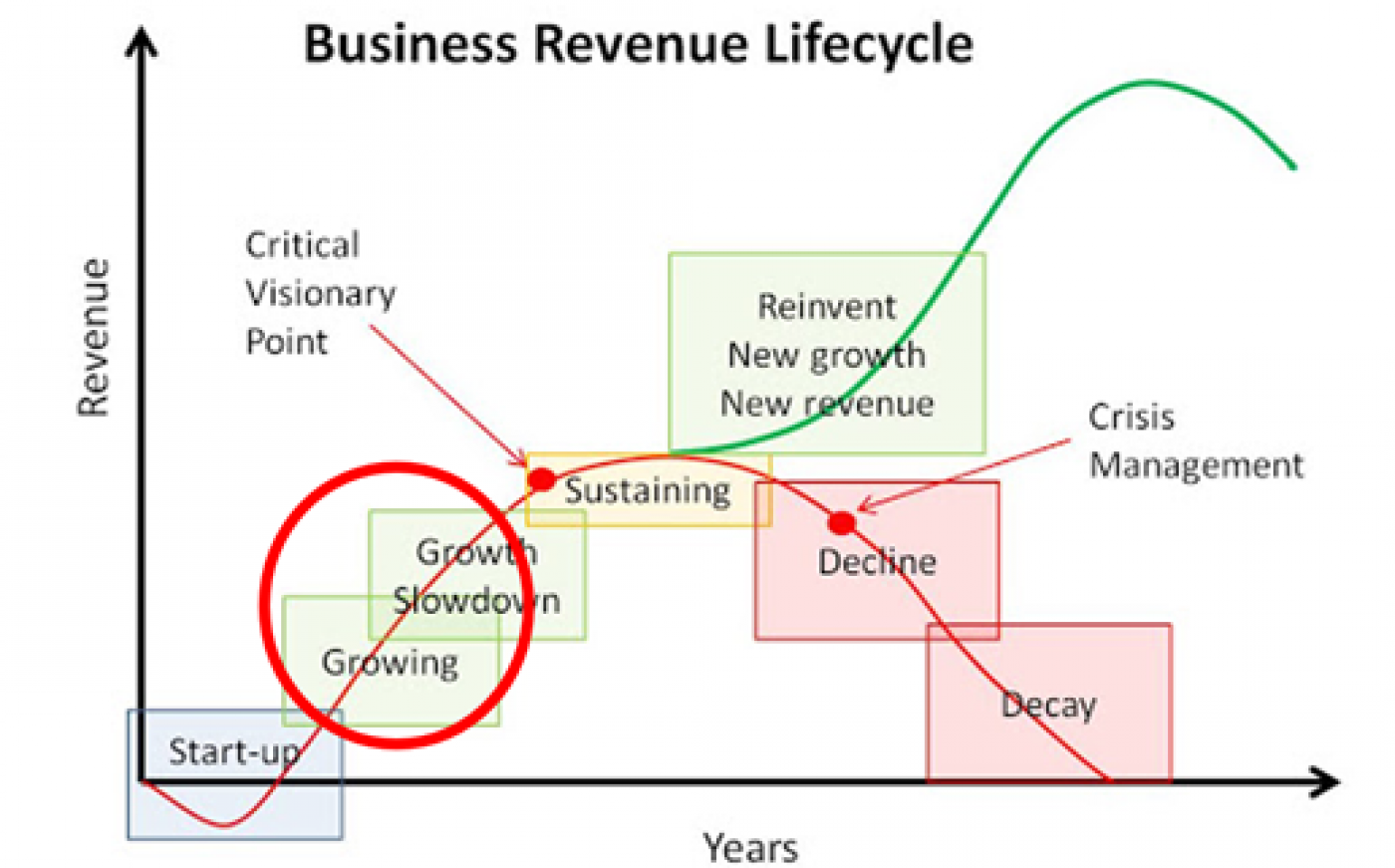

CROWSDESTOR SME loans are not issued to newly established companies (start-ups). The established companies are not our target audience as well, we serve mainly the businesses during the growth stage, and require a track record of a minimum of two years of operational activity track record.

CROWDESTOR, however, sometimes finances the start-up companies, however, they are called “specialized projects”. Specialized and SME projects are perfectly complementing each other as they are bearing different risk, return, and industry characteristics, allowing investors to diversify and choose investment project the better suits their overall investment portfolio.

3. What is the scoring model?

The credit report is the final product of the CROWDESTOR SME scoring model. The scoring model makes the decision whether to grant a loan, how much, and for how long completely automatically using the methodology and data of the established credit rating agencies. The methodology is discussed in detail on the CROWDESTOR website and is publicly available here. The report is ten pages long and is designed for investors and borrowers- what are the strong and weak sides of the business, how financial information translates into the decision, and many other points are covered.

The scoring makes the decision, however, this is not the final step. The human factor is still involved- the CROWDESTOR SME department double-checks the result and on the credit committee, the final decision is made.

How out scoring model is different from other non-bank lending companies and banks? For CROWDESTOR the track record is important, the borrower must show the annual reports for the past two years, no change in the ownership for the past 12 months, and have a revenue of at least Eur 120,000 per year. For some invoice-financing companies, this is not important, they rather look at the existing contracts and invoices, which will secure the stream of cash.

4. What are the 5 underlying criteria?

The scoring model is based on 5 criteria- two financial factors contribute 50% to the model, and three non-financial factors make another 50%.

Financial Factors:

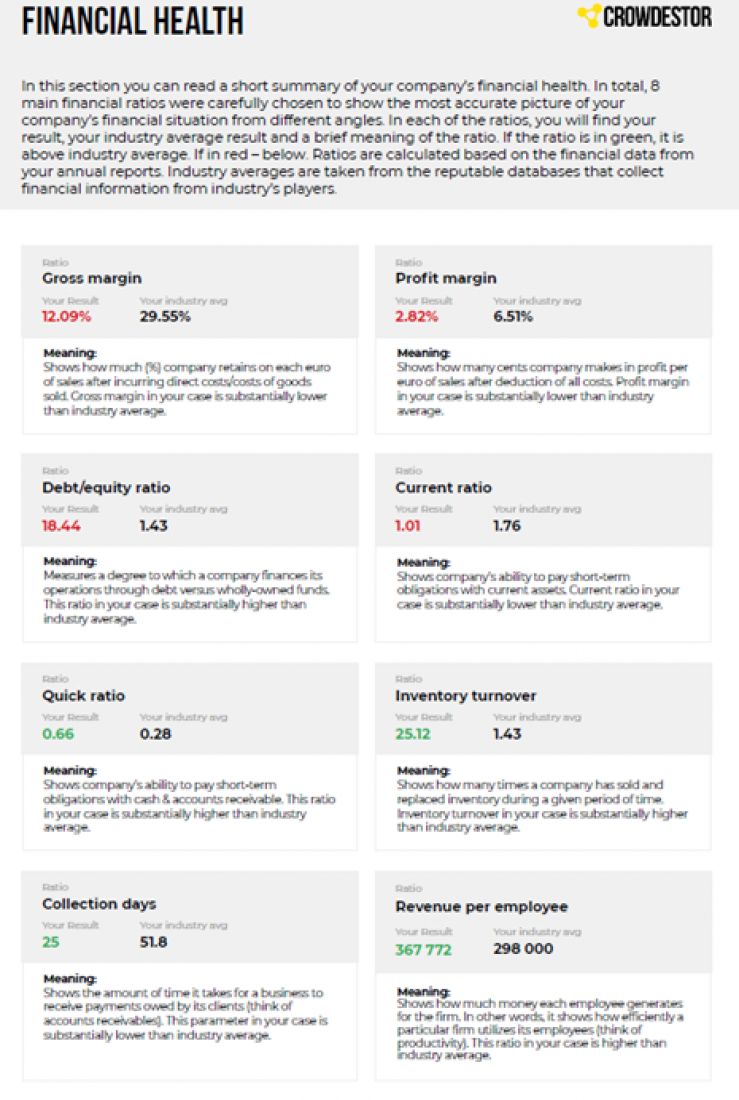

- Annual report analysis: this is the fundamental analysis of financial ratios that can be found in the report- profitability, leverage, liquidity, activity, and other ratios.

- Cash-flow statement analysis. The special software analysis the bank statements for the last twelve months. The most important metric from this report is cash balance- how much cash the company had on average during the last twelve months.

Non-financial Factors:

- Personal credit history: the main person, who puts the signature on behalf of the SME. There is a strong correlation between the business owner’s credit history and the company itself. With SME it is very often that the owner is the board member ass well.

- Business experience. This factor looks at the previous experience of the SME’s founder. If he or she was an entrepreneur for many years there is a high chance that this particular venture will be successful.

- Macroeconomic factors. This applies to external factors such as the market’s macroeconomic climate, political system, or any other country-specific risks.

These 5 factors analyzed together are what make the scoring model so powerful and precise.

5. What data do we use?

While the analyzed criteria are fundamental to our model, the data is the essence. We have a connection to 500 data sources, supplied from several score providers. The information is sourced from the application form and accompanied documents. The obtained information goes through our scoring algorithms which eventually provide us with a reliable answer.

6. How to read the report?

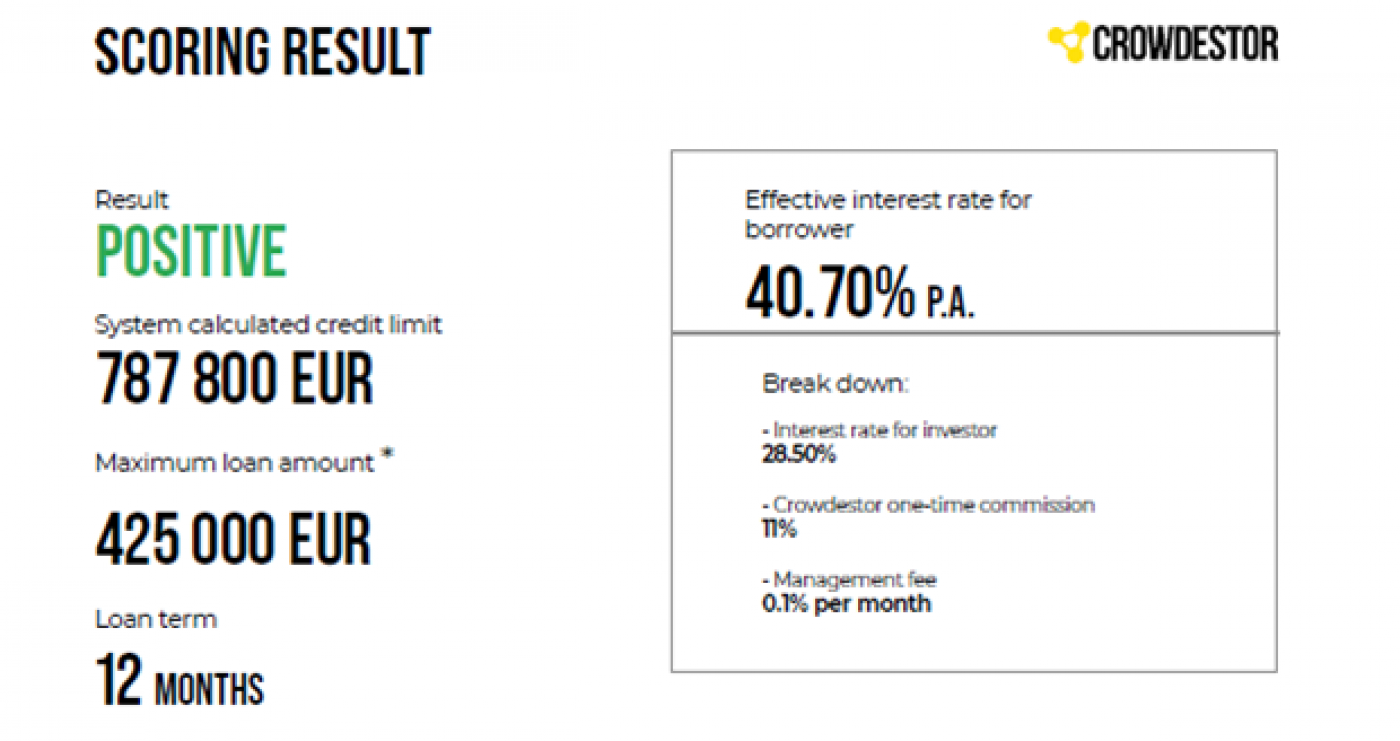

Now, let’s look at the report in detail. The first page gives the most important information: the result, the term, the credit limit, etc.

The next pages in detail show the financial health, strong sides, and what to pay attention to. No other crowdfunding platform provides investors with such detailed information. This is our know-how, and we are transparent with our clients and the whole industry. Every investor can access and evaluate the report themselves when investing in an SME project.

7. What is next?

Among other metrics credit report shows the PD – this is the probability of default in a defined period. Just like we discussed in the first point- the high PD does not mean it will happen. CROWDESTOR will collect data about the issued loans and will compare it to the results of the model- did it correctly estimate the PD and other factors. Moreover, we are continuously making the model even more sophisticated and smart.

Check out our credit report and let us think what do you think- can we provide even more information to you in order to make an informed investment decision?