CROWDESTOR is announcing a new investment opportunity - CROWDESTOR Energy Holding.

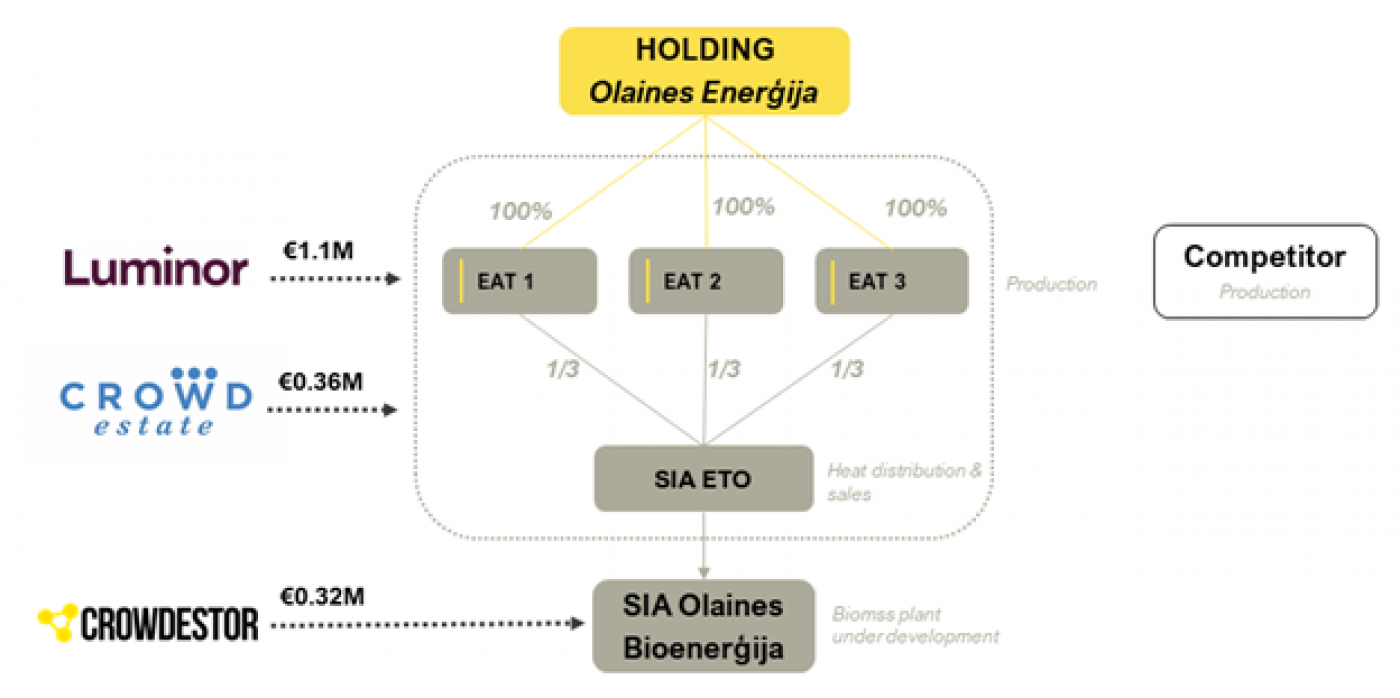

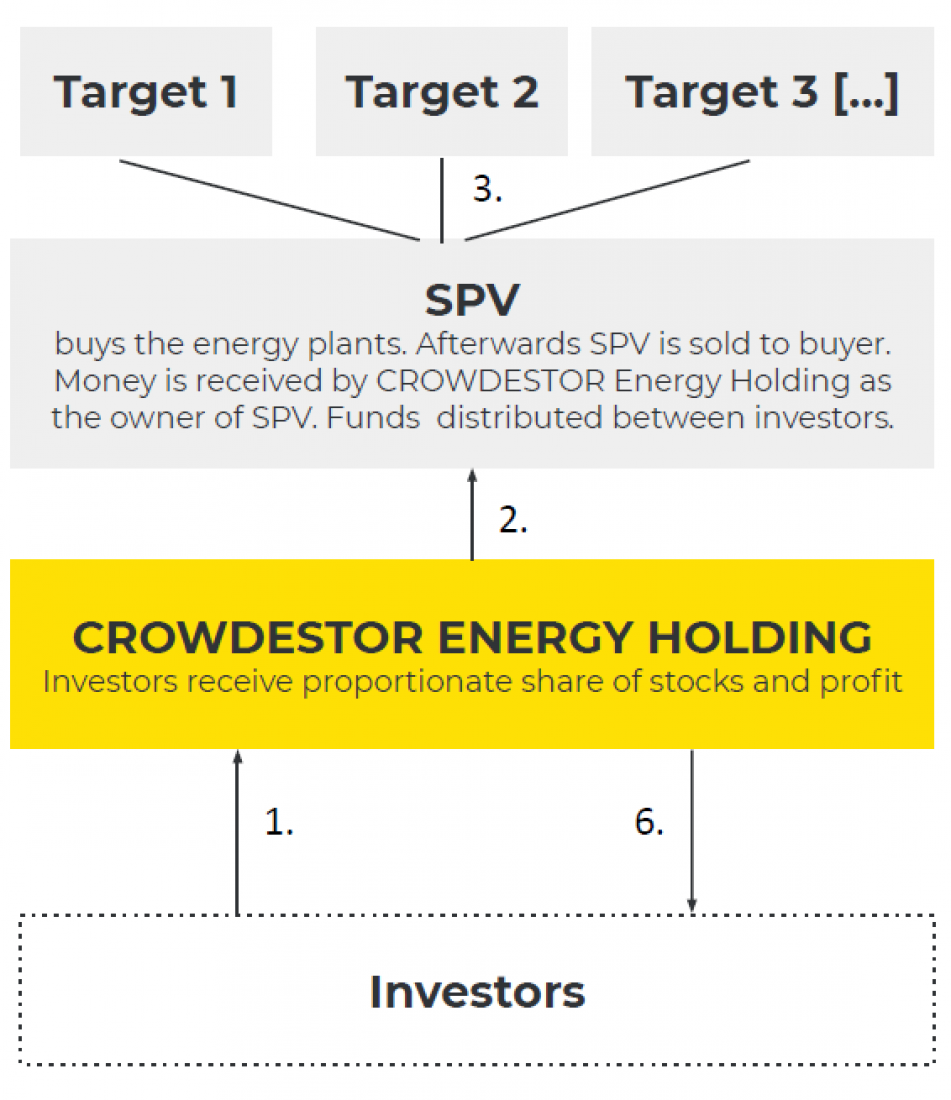

The plan is to become the largest privately held thermal producer in Latvia, by buying out energy production plants that sell thermal power to district heating operators and selling them to an international strategic investor.

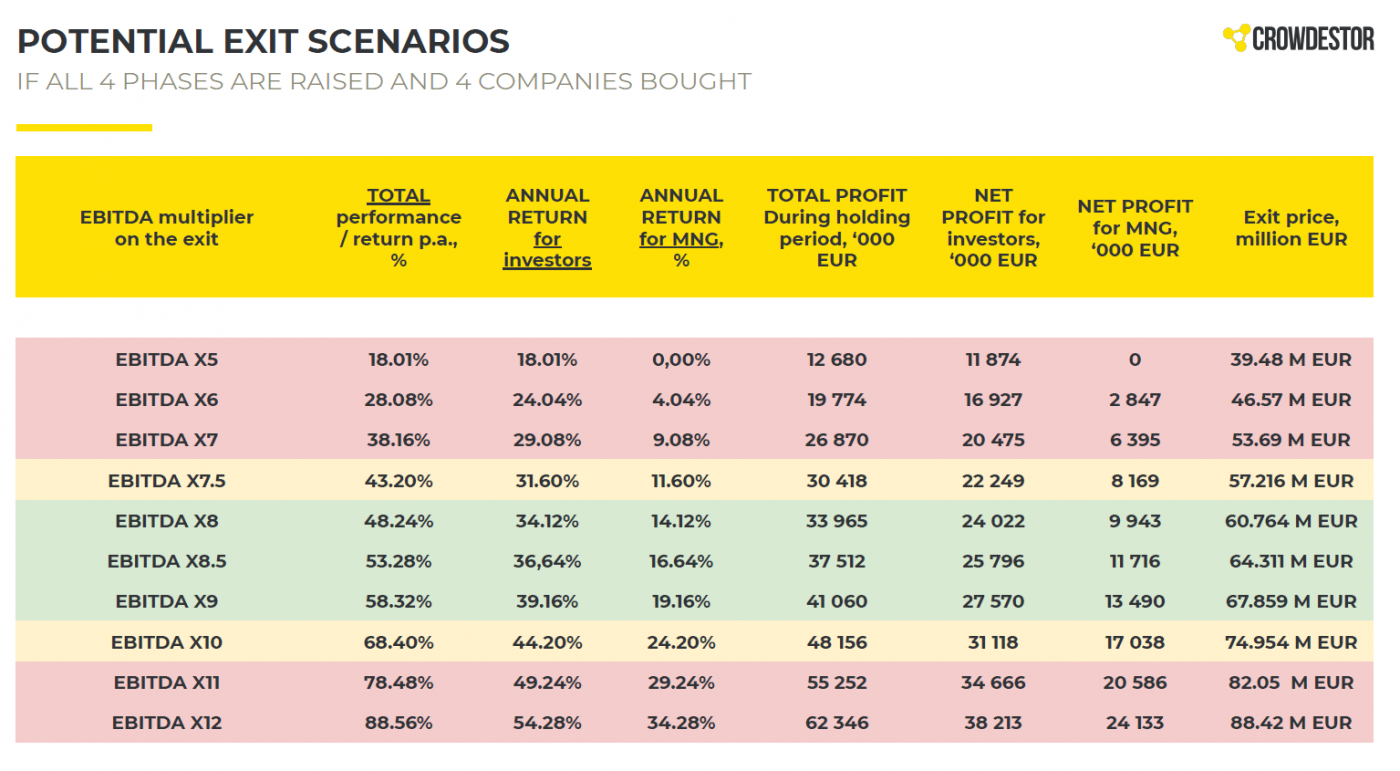

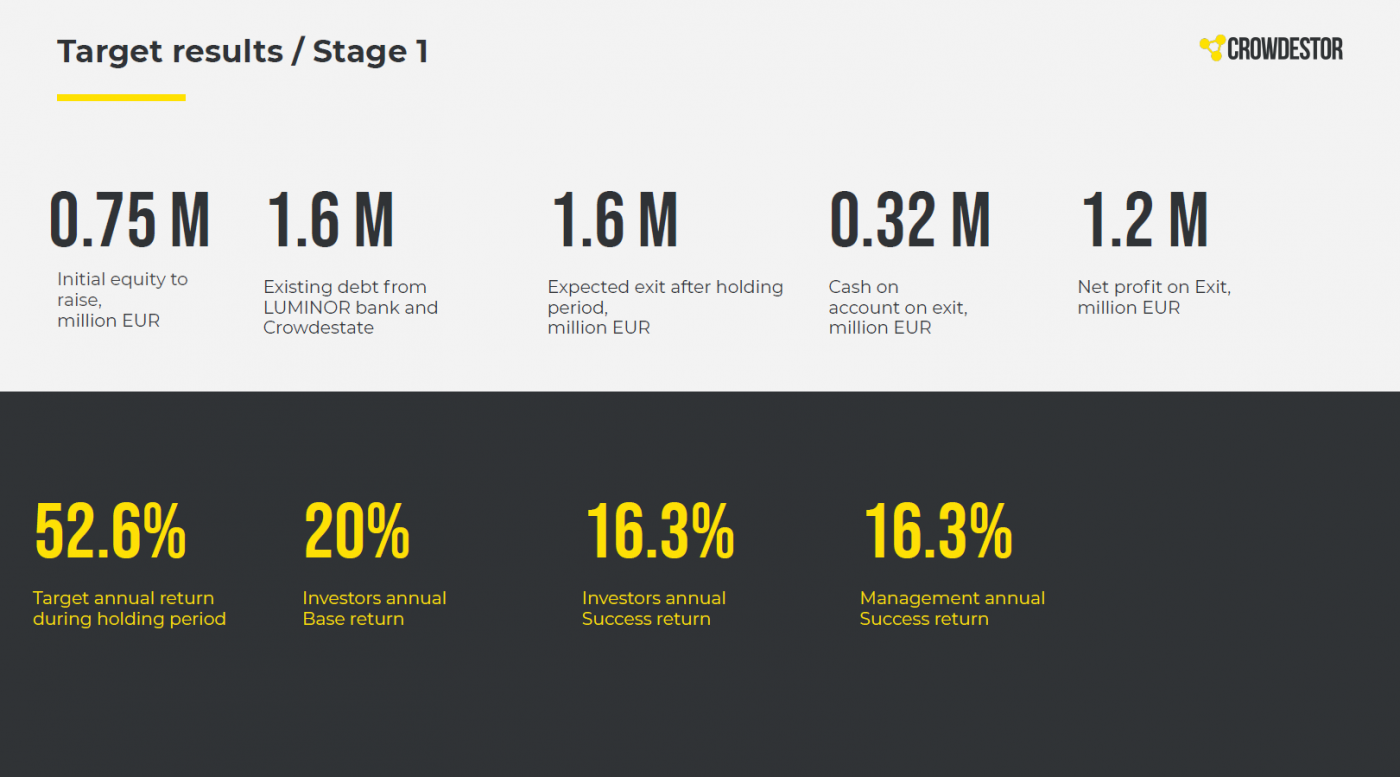

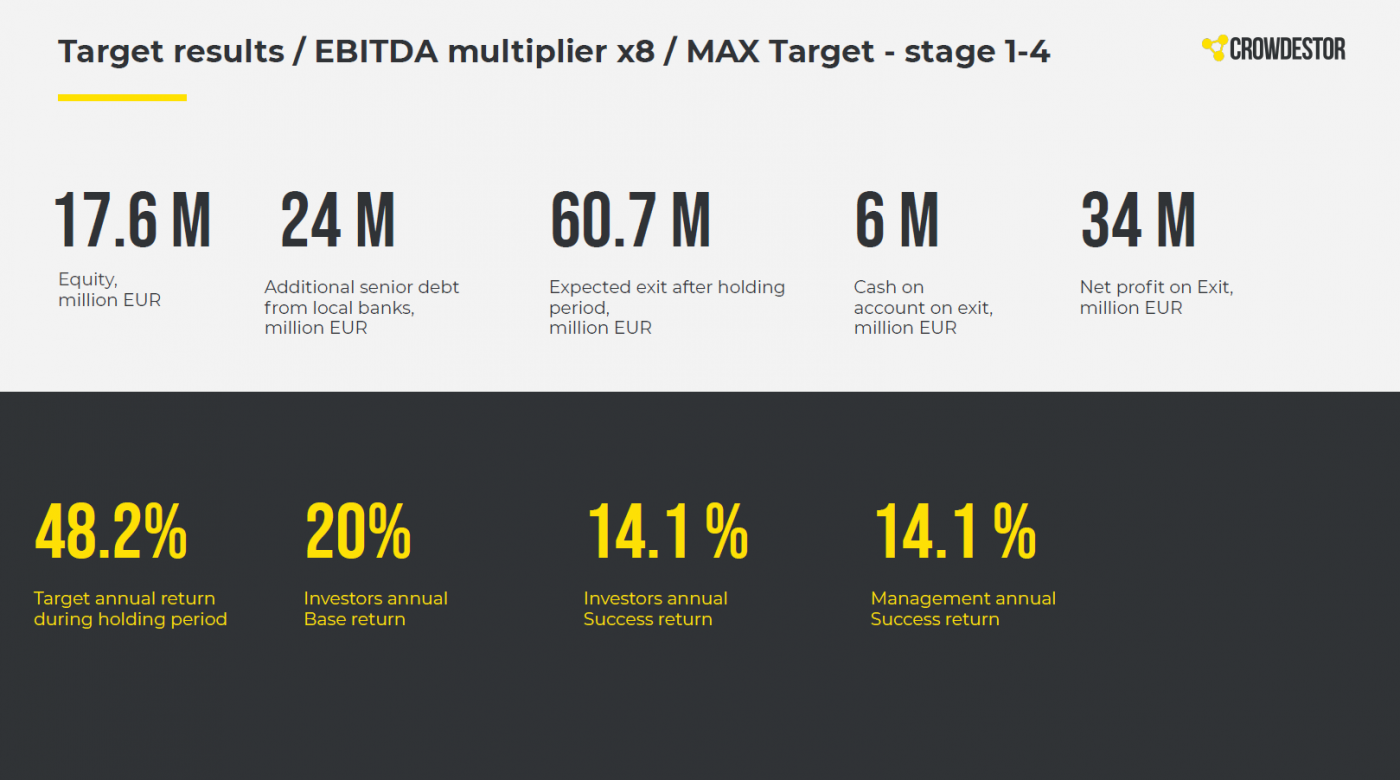

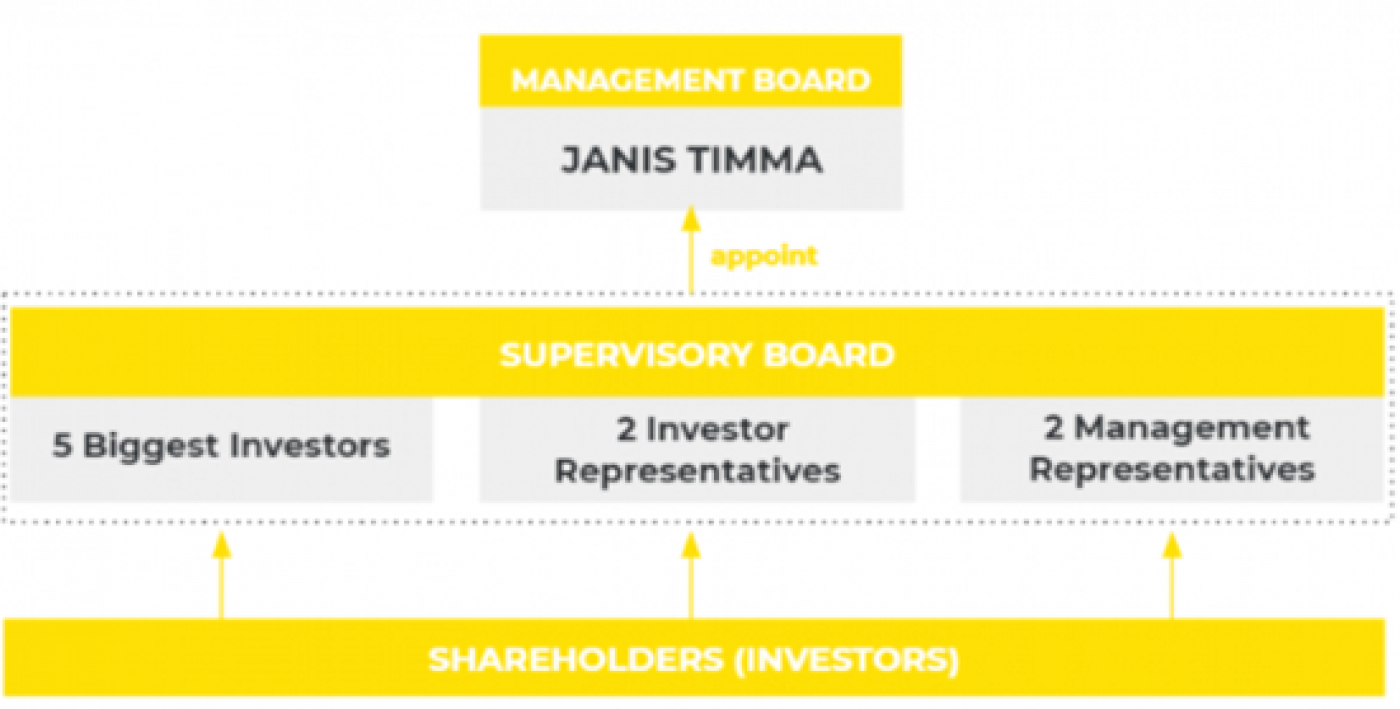

The holding period is 36 months. The targeted annual return for the Holding is in a range of 40-50%, which will be shared between investors and the management of Holding. The net annual return in the first phase project for investors is expected to be 36.3% p.a. The financing target for this round is 300 000 EUR.

The current opportunity offers CROWDESTOR investors to fund the acquisition of an operational natural gas cogeneration plant. This will be the first of four energy projects in the Holding. The funds raised in this round will be used to acquire Olaines Enerģija natural gas cogeneration plant located in Olaine, Latvia.

See the full CROWDESTOR Energy Holding presentation and other relevant information in the Annex.

| Maximum target for 1st round: | 300 000 EUR |

| Minimum investment amount: | 500 EUR |

| Holding period of assets: | 3 years |

| Investors return: | 1) 20% annual base return |

|

2) 50 % of the amount that is above the annual return of 20% |

|

| Target Investors Return: | 36.3% p.a. calculated from the 4th month |

| Repayment: | once the project is sold to a strategic investor |

| Management return: | 1) 20% management fee from EBITDA paid quarterly |

| 2) 50% of the amount that is above the annual return of 20% | |

| Target Management Return: | 16.3% p.a. |

| Collateral: | Corporate Guarantee |

*After the fundraising period or when the full amount has been raised, the investment will be converted into equity shares.

To become the largest privately held thermal producer in Latvia by buying out energy production plants that sell thermal power to district heating operators. Pooling energy assets increase their value. After assets are gathered under CROWDESTOR Energy Holding they are to be sold to an international strategic investor.

The funds raised in this round will be used to acquire three Olaines Enerģija natural gas cogeneration plants located in Olaine, Latvia.

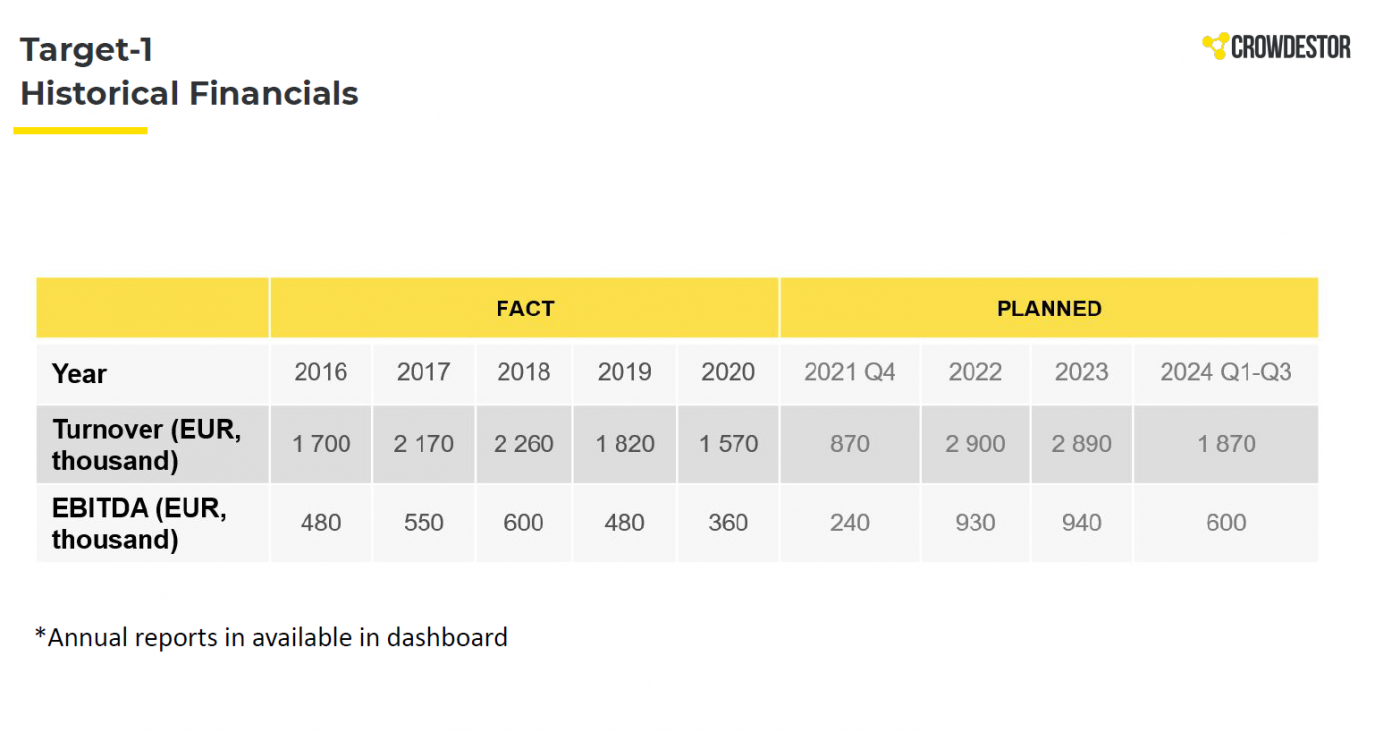

Three natural gas cogeneration stations have been running since 2014. Each of the plants has an energy output of:

The total output of heat is 3.228 MW and the total production of electricity is 2.970 MW. Every station operates about 4 830 hours per year since 2014 until end of 2021. Starting from 2022 energy production plant operates 7500 hours per year.

Up to August 2024, the electricity may be sold under the framework of the Ministry of Economics of the Republic of Latvia on the mandatory purchase of electricity produced in the cogeneration process to Latvenergo subsidiary Enerģijas Publiskais tirgotājs. The heat is sold to the district heating operator of Olaine city.

Note: Olaines Energija power plants are Target 1. Target 2, 3, 4 to be acquired in 3-4 years.

¡Apúntate para estar al día de las últimas inversiones y ofertas especiales!