CROWDESTOR has important news to share, it is safe to say that it is a small step for fintech, one giant leap for CROWDESTOR! Today CROWDESTOR launches a crowdfunding campaign for the acquisition of the licensed payments services provider based in the Czech Republic. The payment service provider will be integrated with the CROWDESTOR Platform.

Invest here.

This strategic move will disrupt the alternative investment platform landscape and will give the CROWDESTOR a competitive advantage. Both, the crowdfunding platforms, and payments service provider are classified as fintech, and by merging the two companies it will create the new synergies benefiting investors even more.

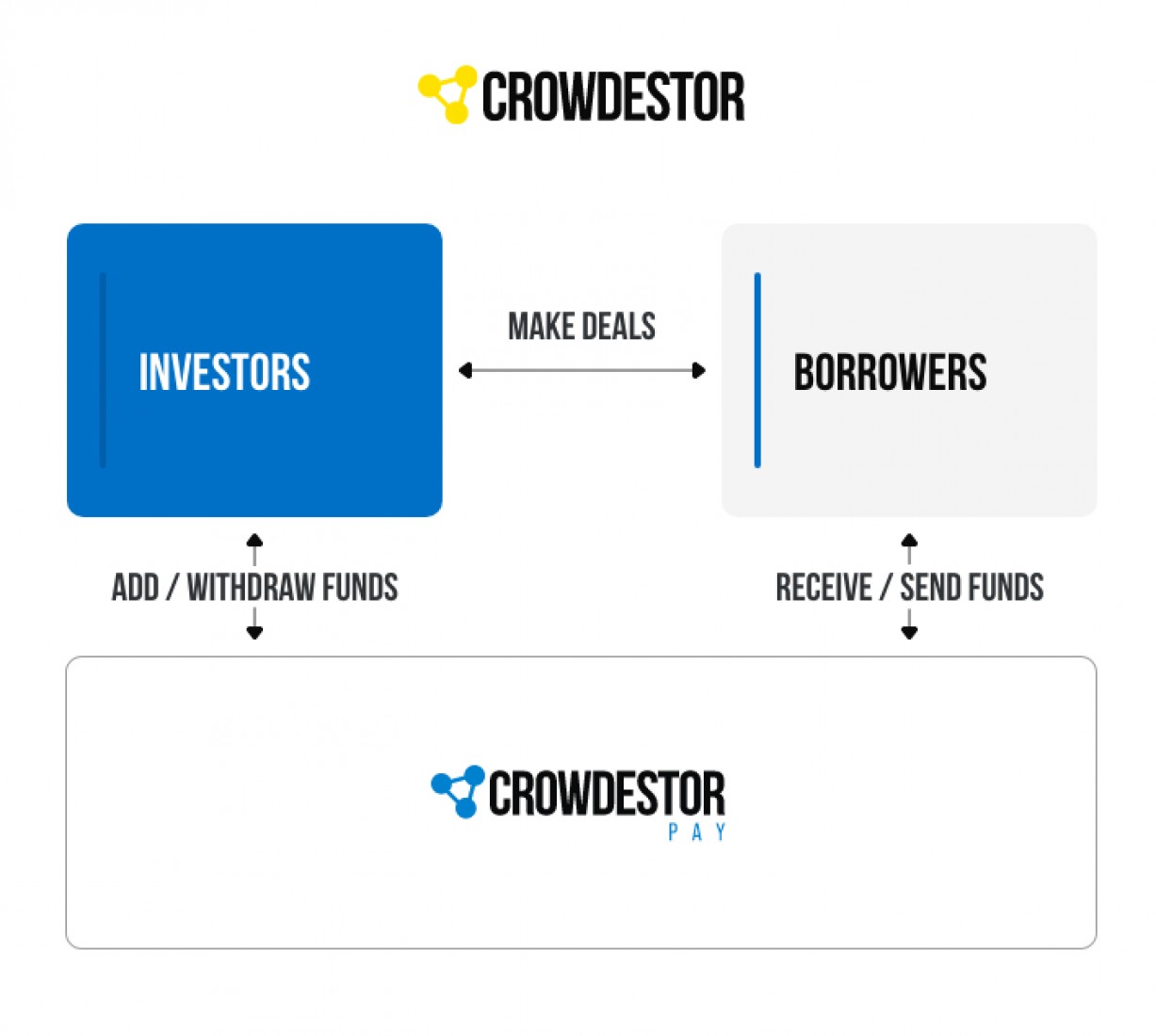

The most important reason for CROWDESTOR to acquire the licensed payment service provider is to segregate the investor’s funds with their own funds. This requirement is already in the draft regulation on European Crowdfunding Service Providers and we want to be ready for when the regulation comes into force. The investors will open an account with CROWDESTOR Pay, which through API will be able to send money back and forth to CROWDESTOR Platform to make investments and receiving the interest and principal repayments on their segregated account with CROWDESTOR Pay. Moreover, the CROWDESTOR Pay account will be also used by the borrowers, who are willing to get the loan funded on the CROWDESTOR Platform. This will create an ecosystem, where payments between borrowers and investors will be transferred without the involvement of the CROWDESTOR Platform.

CROWDESTOR will be able to provide other endless benefits to its customers such as fast transfers, cashback, bonuses, loyalty programs, the account holders in CROWDESTOR Pay will have special deal offers in CROWDESTOR.

The transition to the CROWDESTOR Pay will happen in several stages. First, the CROWDESTOR Platform will open an account, on the second stage each borrower will get an account, and finally, every investor will be a holder of own CROWDESTOR Pay account. This will not only enhance the speed of transfers but also will offer investors and borrowers innovative payment solutions, which are not practiced by the traditional banking system. Besides, the CROWDESTOR Platform and the borrowers, who decided to raise money through crowdfunding will be independent of banks.

Of course, other payment institutions receive very high financing, hundreds of millions in the case of Revolut and some other fintech, but CROWDESTOR Pay is not chasing the big financing rounds. CROWDESTOR Pay’s aim is to steadily improve the experience of our current customer base and to become the leading crowdfunding platform in Europe. The integrated payment solution will assist CROWDESTOR in this ultimate goal. The CROWDESTOR Pay will make the investing experience effortless, convenient, and cost-effective.

In the beginning, CROWDESTOR Pay will provide classical payment services such as SEPA and SWIFT, but later, within a year it will provide debit cards and crypto wallet. In the later stages, the CROWDESTOR Pay will develop a dedicated mobile app, which is essential for satisfactory user-experience.

Benefits of CROWDESTOR Pay for CROWDESTOR Crowdfunding Investors

- Shorter waiting period for transfers to arrive at the investment account

- Ease of withdrawal, topping up

- Manage your finances and investments in one place

- Competitive conversion of foreign currencies to Euro

- Get an additional bonus for investing your funds through CROWDESTOR Pay

- Segregation of investor’s funds from platforms funds

The main mission of CROWDESTOR is to help small and medium companies across the EU thrive, which is the backbone of the competitive economy. Especially during such challenging times, as we are witnessing now, it is painful to see how the economic growth that has been achieved during the past several years has been erased in a matter of a quarter. This makes the activities of CROWDESTOR especially important because we facilitate the financing of SMEs and other projects like Warhunt movie, Medical Centers, concerts, games on the Appstore.

On the other hand, we have investors, who are searching for a competitive yield in this uncertain environment or simply want to participate in the funding process. According to the deal room, the investments by Venture Capitalists into the fintech industry have reached 20% of total volume. Furthermore, the majority of the revenue is generated from the Payments Providers. Venture Capitalists manage funds worth several million and usually very large institutional investors can participate and earn an interest rate.

We think that in modern times and given modern technology this is not fair. We strongly believe that anyone who is willing to invest in fintech should have the ability to do so. Of course, these are not the risk-free investment. The investments in a start-up may fail, but when they do not the profit is compensating all risks ever taken. This why the interest rate on the CROWDESTOR platform, is above the market.

We invite you to facilitate the development of the leading crowdfunding platform in Europe.