As the CEO of CROWDESTOR, I am delighted to be able to bring this marvelous investment opportunity to you. I have received huge interest and support from you in regard to this project which only makes me appreciate your trust and loyalty in my own projects particularly.

As many of you know, since 2010 I have been also actively engaged in the energy sector, focusing on development and capital raising for a different type and size of energy plants. Since 2013 I am the CEO of the Latvian Cogeneration Association and have an active role in communication with government institutions regarding improvements of energy sector regulations in Latvia. I have been developing my first energy plant from 2015 until mid-2018. It has been a very complicated process, during which I have gained tremendous experience and confidence that it is a sustainable and, in my opinion, a safe project opportunity in the long-term.

I am currently working on a very ambitious project - to develop the largest privately held heat production plant in Latvia. Powerhouse Sarkandaugava is a 52 MW thermal power woodchip heating plant development project. CROWDESTOR investors are offered to invest for 12-18 months while the project is being packaged for sale to a strategic equity investor.

The packaged project for sale will include developed land plot ready for construction, construction project, all necessary permits, turnkey agreement with an experienced contractor. The expected transaction value at a Negative scenario is 4 million EUR up to 6.7 million EUR as the Target transaction size.

Riga heating market is regulated and guarantees heat off-take from all market participants and Powerhouse Sarkandaugava will have a competitive advantage in this market due to competition with out-of-date gas heating stations. Moreover, woodchips as a green heating source are readily available in the region and ensure stability and sustainability in the long term. It is important to stress out that Latvia’s woodchip production has exceeded domestic consumption over the past ten years, which means that the excess woodchip supply is mainly exported. Woodchip net exports contributed to 15% of total production in 2018.

Over the past week, I have already felt an increased interest in this project from your side with requests for more detailed information and questions about the significant interest rate. Firstly, you will have access to detailed information about the project assessment and potential in your profiles. And secondly, as I am doing it with the assistance of CROWDESTOR investors, I want to share a part of the profit with them. That is why a fixed 32% annual interest rate is offered. With 32% annual interest rate CROWDESTOR investors will have 33%, which is one third, from total profit if Project is sold at the Negative scenario - 4 million EUR.

Every success story in CROWDESTOR increases the value and reputation of the platform, and together with the growth and satisfaction of our investors, it is the most important company success indicator to me.

You will have an information memorandum in annex. As it contains sensitive information, it is marked as confidential and is meant for individual use, can not be shared.

Best regards

Janis Timma

CEO of CROWDESTOR

Founder and 100% owner of Powerhouse Sarkandaugava

CROWDESTOR is proud to announce a new and exciting project opportunity to our investors only here, we bring to you the project - Largest Privately-held Heat production plant in Riga.

52 MW thermal power woodchip heating plant development project already in the process. It is the largest privately held heat production plant in Riga and one of the largest privately held heat production plants in the Baltics.

CROWDESTOR investors are offered to invest for 12-18 months while the project is being packaged for sale to a strategic equity investor. Value of the Project when construction permit and all final approvals received is up to 8 million EUR. The project is expected to be sold for a price in a range of 4 million EUR to 6.7 million EUR. The base scenario is to develop a project and sell it to an investor which builds it.

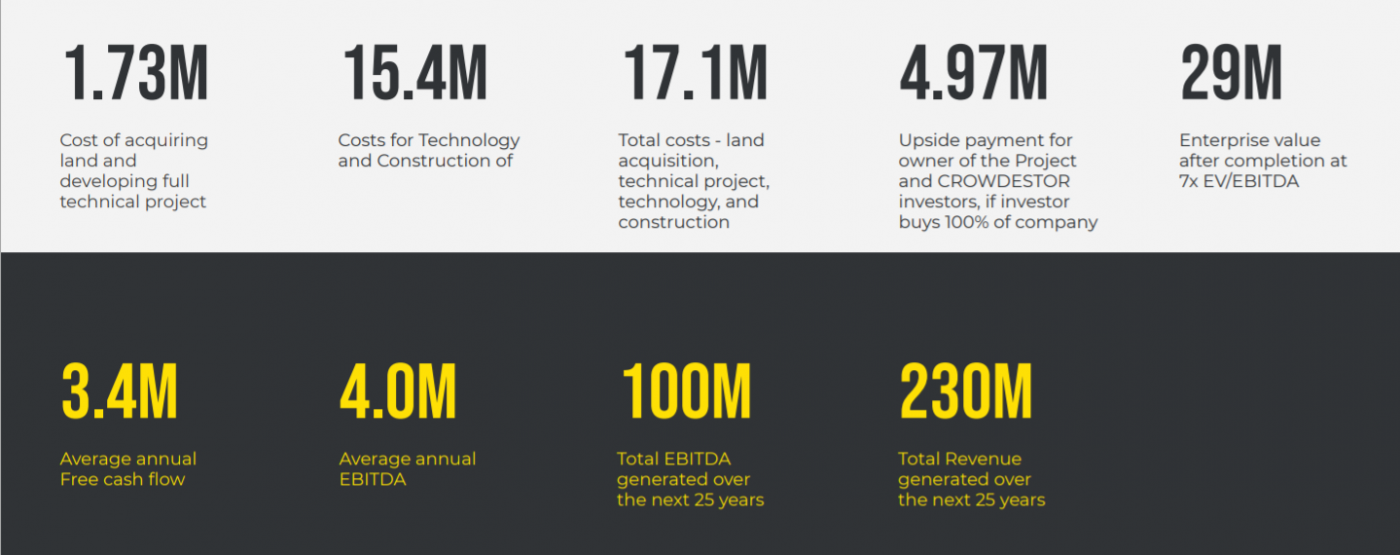

There is also an alternative development scenario. To attract an equity investor which buys out CROWDESTOR investors and invests necessary capital to build the plant, the Long-term scenario. In this case, the necessary investment in boilerhouse development is 17.1 million EUR, of which 60% is expected to be financed by a bank loan. The revenue will be generated via the sale of heat with a focus on the cold heating season from October to April. The enterprise value after development is set to reach 29 million EUR. From the second year of operations, EBITDA is calculated up to 4.1 million EUR. Total EBITDA in 25 years of operations in 100 million EUR, turnover 230 million EUR.

LOAN

Largest Privately-held Heat production plant in Riga (III):

Largest Privately-held Heat production plant in Riga, FINAL (IV):

Remember - interest rate payments start calculating from the day you make your investment!

The 52 MW thermal power heating plant (including a 12 MW flue gas condenser) will be in Riga, Latvia. The total project investment is calculated to 17.1 million EUR which consists of:

The expected operations are from October - April and 2 weeks in May and September, in total 5,286h p.a. It will be powered by biomass – woodchips – a green, renewable energy source.

The heat offtake will by district heating operating company Rigas Siltums and it will be located in an industrial zone with limited competition. The land plot has been purchased and the technical project for building, technology, and utilities is under development.

The industry is legislated by Energy Law and Competition Council decisions and Natural gas stations like TEC-1 have regulated tariffs based on the gas price. In addition to procurements being limited to the right bank of Daugava river – the right bank is divided into 2 zones - TEC-1 and TEC-2 zones which do not compete with one another during the heating season. TEC-1 & TEC-2 are owned by Latvenergo, a state-owned energy company and are competitive due to obligatory procurement boosting electricity prices

TEC-1 electricity procurement term ends in October 2020 – afterward its pricing will become uncompetitive. The zones compete with one another only during the summer when heating needs are significantly lower and TEC-2 is in condensing mode.

After Powerhouse Sarkandaugava is finished both independent stations in the TEC-1 zone will be owned by the same owner – Jānis Timma – therefore it is the best location for the project development. Both energy plants will have limited competition during the heating season.

The project is expected to be sold for EUR 6.7 million EUR which will provide the funds to repay CROWDESTOR investors. Necessary investment in the powerhouse development phase is the 1.73 million EUR from which EUR 0.45 million EUR has been raised and invested already.

The total costs, including development phase, construction, and equipment are 17.1 million EUR, of which 60% is expected to be financed by a bank.

Turnkey agreement with contractor will mitigate the construction and technology setup risks.

Latvia’s woodchip production has exceeded domestic consumption over the past ten years. The excess woodchip supply is mainly exported. Woodchip net exports contributed to 15% of total production in 2018. The woodchip prices are volatile on a month-to-month basis, but moving averages have stayed around 13-15 EUR/MWh, reaching the price of 21 EUR/MWh in heating in 2018. At the moment prices have decreased slightly under 13 EUR/MWh which is a new record low in recent years. The long-term price trend moves up with inflation.

Riga's heating market is regulated and guarantees heat off-take from all market participants. Powerhouse Sarkandaugava will have a competitive advantage in the Riga heating market due to competition with out-of-date gas heating stations. And the heating zone surrounding Powerhouse Sarkandaugava has limited competition.

Woodchips, as a green heating source, are readily available in the region and ensure stability and sustainability in the long term. Rigas Siltums purchases heat for the Right side of the Daugava river via tender processes in weekly bids that are dominated by old natural gas stations TEC-1 and TEC-2 which are owned by the Latvian state. Rigas Siltums is obligated to sign procurement agreements with equal agreement rules with all certified heat suppliers, therefore, competitive companies can sell heat within Riga based on economic ranking principles by outbidding TEC stations

Energy Law stipulates that a centralized heating operator (in Riga – Rigas Siltums) is required to purchase heat through procurements according to economic ranking principles. Competition law and competition councils' previous decisions about the energy market stipulate that a company with a dominant position (such as Rigas Siltums) must follow economic ranking principles during procurements. The cheapest bids win procurements and can sell their heat.

The turnkey agreement with Axis Technologies will be signed within 6 months (before the project is sold to a strategic investor). Axis Technologies has constructed and set up more than 850 MW of heating capacity in the region, the majority in the Baltics. Axis Technologies is one of the leading biomass energy and metal processing companies in Northern Europe, with more than 20 years of experience in the industry. They have built boiler houses for heat and power production all over Europe and implemented more than 200 biomass boiler house projects. Axis Technologies assumes total responsibility from design through the completion of the project. The project will be ready to begin operations and produce cash flow upon completion.

During the heating season heat suppliers compete with the TEC in their area (instead of among themselves) and usually win because the heat demand greatly exceeds their total production capacity. In TEC-1 zone competition will be between Janis Timma’s owned stations (Powerhouse Sarkandaugava & Eco Energy Riga) against state-owned TEC-1 whose electricity procurement term ends in October 2020 decreasing its pricing competitiveness.

TEC-1 and TEC-2 are competitive mainly due to mandatory procurement components that offer subsidies for electricity tariffs that can offset heat losses. Even then, the majority of other suppliers provide lower heat prices during the season. TEC tariffs are publicly available due to the regulations thus making it much easier for Powerhouse Sarkandaugava to outbid TEC-1 and sell heat.

An energy company “Powerhouse Sarkandaugava” LTD is a district heating system in Riga and it is owned and managed by municipality owned operator JSC “Rigas Siltums” which buys thermal power from independent energy producers. There are only seven energy production plants in Riga.

The Borrower is an SPV “Powerhouse Sarkandaugava” SIA, a company registered in the Republic of Latvia with registration number 40203189833. The Shareholder and CEO of “Powerhouse Sarkandaugava” SIA is Janis Timma, who is also shareholder and CEO of CROWDESTOR OU.

Janis has been actively engaged in the energy sector since 2010, focusing on development and capital raising for different types and sizes of energy plants. He has been the Head of the Energy Department in BDO Law for 6 years. Since 2013 Janis is the CEO of the Latvian Cogeneration Association and is having an active role in communication with government institutions regarding improvements of energy sector regulation in Latvia. Janis is also CEO and shareholder of 14 MW biomass boiler house in Riga. He is educated in Finances at the University of Latvia, Law at Business University Turiba, and in WU Executive Academy, program as an Executive Energy Expert.

Subscribe to our newsletter and stay updated on the latest investments and special offers!