Team of experienced debt collection business leaders with 10+ years’ experience has established a project for acquisition of consumer and other secured loan portfolios with the goal to manage scheduled payments and debt recovery. Acquisition decision is based on latest collection data on Georgian market as well as the price of portfolio leading to considerable discount on open loan principal and interest.

In this investment opportunity funds will be used to acquire a major Bank’s car lease loan portfolio in Georgia, which consists of 500 car lease loans with average delayed payments of 180 days.

The open debt portfolio principal is 903 226 EUR, total debt is 1 935 484 EUR. This portfolio is a typical lease which is backed by vehicles as collateral and are discounted by 50% from outstanding principal value. Besides this even in case the vehicle fast realization value would not cover outstanding total debt, collection of such debt would continue even after the sale of collateral (vehicle).

Acquisition decision on particular portfolio was based on past years collection efficiency data for Georgian market and the projection of the portfolio foresees the collection process to deliver over 100% ROI over a period of 24 months, and 144% recovery of initial investment after interest and other expenses over the first 12 months. Interest and partial principal payments to investors will be initiated from the second month the project.

Current investment opportunity offers CROWDESTOR investors to make a loan with 24% annual interest rate. High yield can be offered due to the nature of lease loan repayments which are monthly based, thus enabling repayments of principal as well as interest to be made on a monthly basis, ensuring higher investment liquidity and investor safety than in case of one bullet payment at the end of the loan term.

Minimum target to be raised in CROWDESTOR platform is EUR 200 000,00 and the maximum target is EUR 550 000.00.

Pledge on the portfolio is held by CROWDESTOR OU throughout the duration of the project.

Max. target: EUR 550 000

Min. target: EUR 200 000

Loan term: 12 months

Interest rate: 24% per annum

Interest payments: paid monthly

Loan repayment: monthly including partial principal payment with final repayment at the end of the Loan Term

Crowdestor.eu BuyBack fund: Yes

Security:

Remember - interest rate payments start calculating from the day you make your investment!

Dear Investors,

In this letter, I would like to give you an update on our first project, which is financed by some of you.

First, me and our team want to thank you for your trust in the project and investment. We have taken all the necessary due diligence measures required not only by Crowdestor, but also our own internal procedures, thus insuring responsible and profitable allocation of investment.

Next, in order to ensure transparency and follow-up on project execution, we will provide an update on the actual portfolio management process results compared to our initially planned portfolio performance on regular basis.

According to first projects, funds were used to acquire loan portfolios, first one consisting of 6486 issued loans and at the time of acquisition 67% were customers with no delays, 13% with delayed payments of less than 90 days and 20% with delays up to 220 days. The total open debt portfolio as of October 24th, 2019 was 1 588 983 EUR, accordingly LTV 35%.

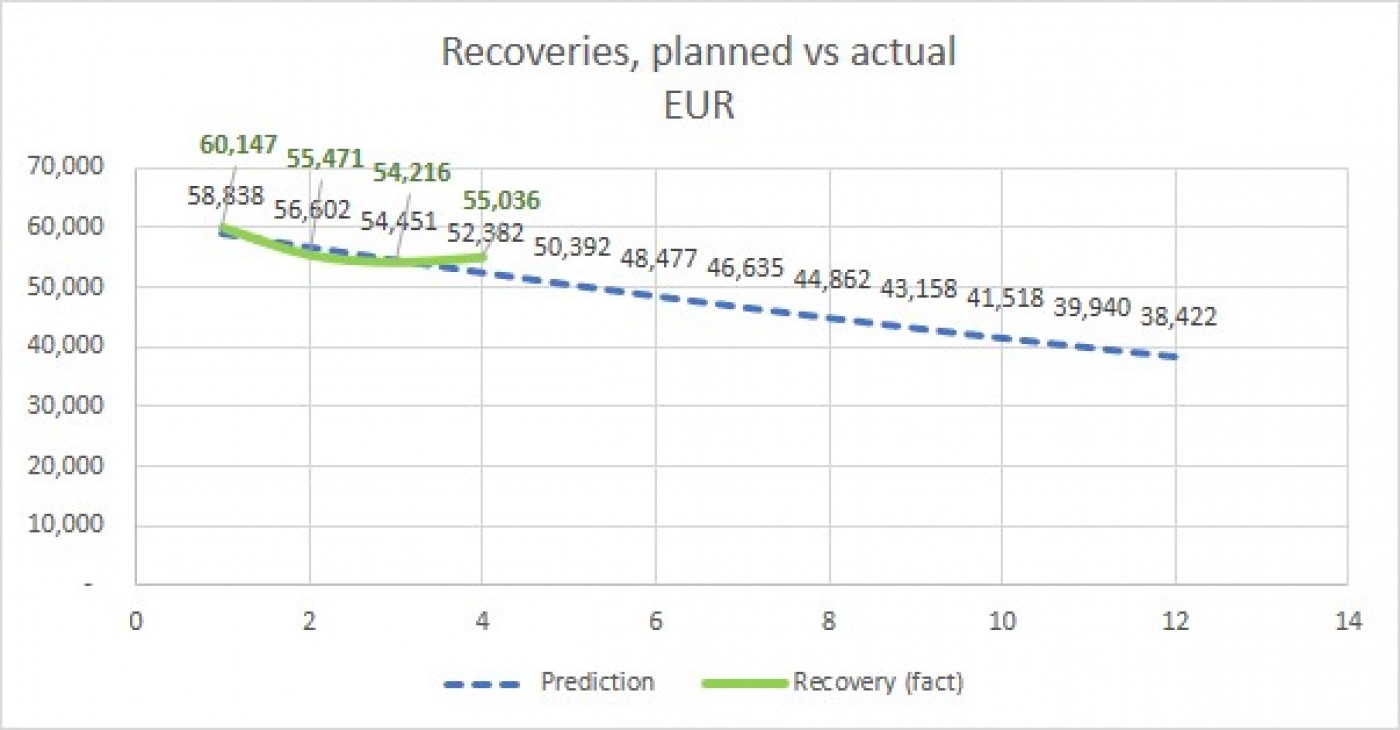

For portfolio management we use the latest market debt recovery data – efficiency, to determine planned cash flow. Bellow, you can see planned compared to actual portfolio performance.

We are glad to say that our projections have been well within the industry acceptable 10% margin of error, thus we can safely assert that project execution is moving according to the initial budget and roadmap. In addition, we have already made repayments of 167 000 EUR to Crowdestor investors covering principal and interest.

On a final note, I would like to mention that we are constantly looking for new portfolio acquisition opportunities, at the moment we are in the negotiation of several very promising and profitable deals, one of witch we are presenting in this prospect and we will continue to propose these opportunities to Crowdestor investors. Company goal is to invest 10 million EUR in portfolios in 2020.

In case you have any questions, comments or simply are interested in a more in-depth understanding of loan portfolio management, please do not hesitate to contact me directly @ b.rapava@nomo.ge or by WhatsApp +995 599 35 38 68.

With gratitude,

Bachana Rapava

CEO and Co-Founder

Nomo LLC

M: +995 599 35 38 68

E: b.rapava@nomo.ge

Latest message from Bachana Rapava, CEO and Co-Founder of the project:

Bachana Rapava, CEO and Co-Founder

Bachana’s expertise in managing consumer lending business and debt collection spans over a period of 10 years. He has worked in two major financial organizations - Bank of Georgia and Twino. During his employment at Twino he held several roles over the past 6 years - including Head of Debt Collection and Customer Care, and Regional Country Manager for Georgia and Kazakhstan.

More detailed information about Bachana’s experience you can find here: https://www.linkedin.com/in/bachana-rapava-238320157/

The partner company is run by a team of highly experienced management in the field of debt collection and loan portfolio management. It was founded in 2015, with the goal to serve major microfinance organizations and banks on the Georgian market. Over the past 5 years the company has seen a very rapid growth which was driven by exceptional results of loan portfolio management, consolidating trust among organization’s clients and their debtors, with the status of a mediator, as well as promoting core strengths in problem asset management, and offering full extent of legal collection services.

The Financial Bureau also carries out investments in problematic loan portfolio assets. Furthermore, it aims for transparency and acts within the legal framework of the market, with reputation stipulated by the highest standards.

With their own and international multi-year expertise, the Financial Bureau management team has developed an effective problem asset management system which covers all stages of loan processing, while corresponding to all modern tools and tac. Moreover, it protects both - the company and the borrower interests.

Clients: Bank of Georgia, Vivus.ge (4Finance Group), Netcredit.ge (Twino), Lendo.ge, Mogo.ge, Moneza.ge, Mycredit.ge, Credia.ge, Mon.ge, Wandoo.ge and others.

Staff: 500+ employees

Locations: 20 branches all over Georgia

According to the National Statistics Office of Georgia, population in Georgia is 3,723,000. GDP per capita (at current prices), 1081 USD. Money supply (M3), 21.1 billion Gel. Foreign Direct Investments in 2018 was 1 265 Million USD. External Trade Turnover period 2019 JAN-SEP was 9 193 Million USD.

As of October 2019, the loan portfolio of commercial banks was GEL 30.4 billion, from which GEL 13.6 billion were loans denominated in national currency and loans in foreign currency was 16.7 billion.

Annual growth of GDP in the second quarter of 2019 was 4.5%, with an 8-month average growth of 5%, according to preliminary data. These figures are in line with the forecasts of the National Bank so far. Despite recent risks, relatively high economic growth during 2019 was largely driven by increased external demand. According to the figures for 2018, Georgia's GDP was 41 billion GEL.

According to Georgia National Bank Forecast of real GDP growth is expected for 2019-2020. Economic growth in 2019 will be more than 4.5%.

Doing Business 2020, a World Bank Group flagship publication of annual studies measuring the regulations that enhance business activity and those that constrain it. Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 190 country economies.

Georgia has advanced in the Doing Business rankings and moved to seventh place. Ratings include different criteria. Georgia has the best results in the criterion of minority shareholder protection and is ranked second in the world. Georgia ranks fourth in the world in terms of starting a business. Georgia also ranks fourth in property registration criteria.

Why it is financially profitable for LLC Nomo to pay 24% annual interest rate?

Planned ROI for the portfolio acquired at the agreed price is over 100% over a period of 2 years, enabling borrower to repay the initial investment by monthly partial principal payments within first 12 months of collection initiation.

What happens if LLC Nomo fails to pay interest and/or principal payment?

If LLC Nomo delays interest payment or principal payment for more than 30 days, pledge will be realized, and loan assets and collateral will be auctioned by CROWDESTOR.

Are the deal documents signed already?

Cession agreement signing is scheduled no later by 10th March.

¡Apúntate para estar al día de las últimas inversiones y ofertas especiales!