Team of experienced debt collection business leaders with 10+ years experience have established a project for acquisition of consumer loan portfolios with the goal to manage scheduled payments and debt recovery. Acquisition decision is based on latest collection data on Georgian market as well as the price of portfolio leading to considerable discount on open loan principal and interest.

Funds will be used to acquire Loan portfolio, which consists of 6486 issued loans out of which 67% are customers with no delay, 13% with delayed payments of less than 90 days and 20% with delays up to 220 days. The total open debt portfolio as of October 24th is 1 588 983 EUR, accordingly LTV 35%.

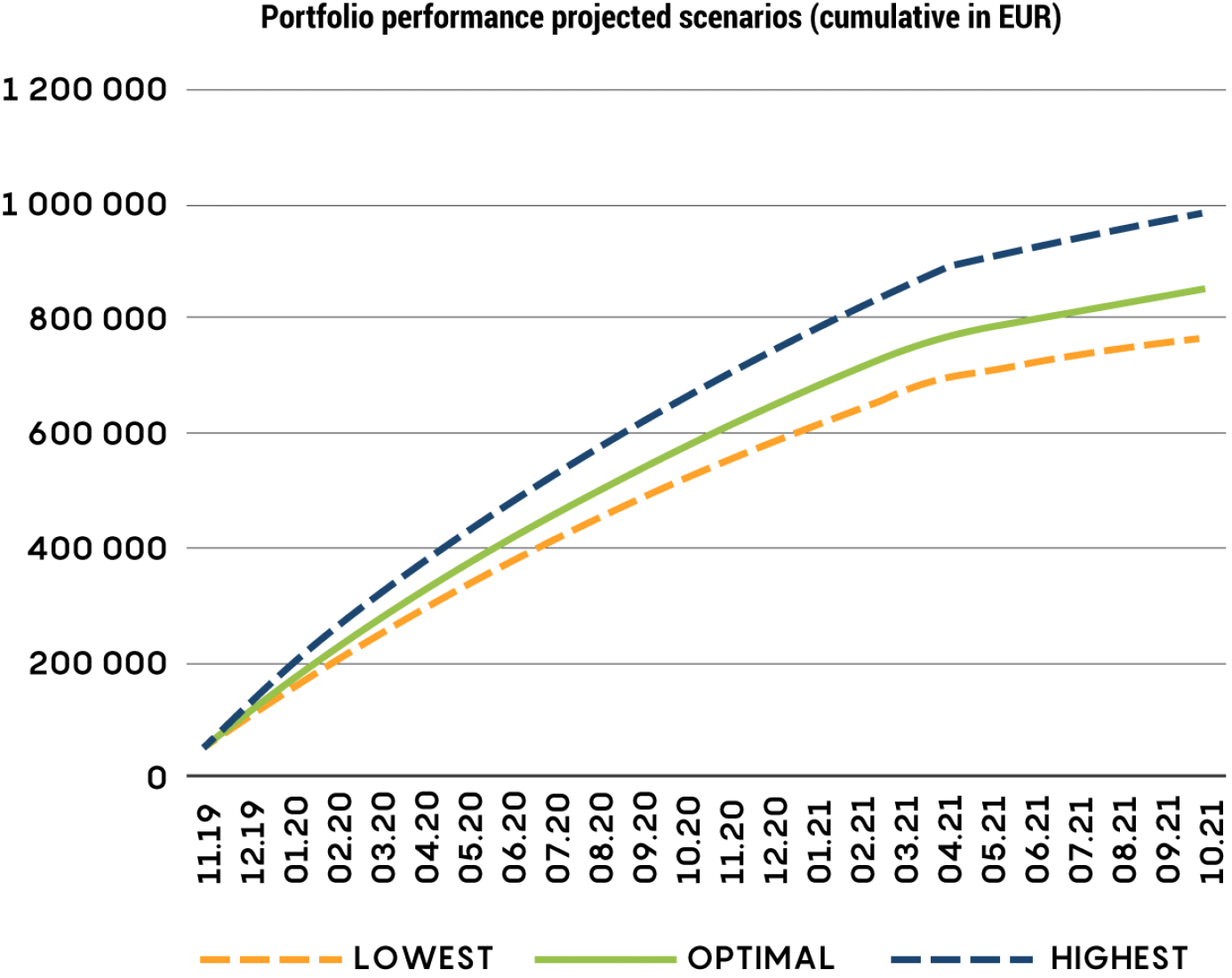

Acquisition decision on particular portfolio acquisition was based on past 10 year collection efficiency data for Georgian market and the projection of the portfolio foresees the collection process to deliver 94% ROI over a period of 24 months, and 124% recovery of initial investment after interest and other expenses over the first 12 months. Interest and partial principal payments to investors will be initiated from the first month the project. First month collection have had a 5% increase compared to budgeted projection.

Current investment opportunity offers CROWDESTOR investors to make a loan with 24% annual interest rate. High yield can be offered due to the nature of instalment loan repayments which are monthly based, thus enabling repayments of principal as well as interest to be made on a monthly basis, ensuring higher investment liquidity and investor safety than in case of one bullet payment at the end of the loan term.

Minimum target to be raised in CROWDESTOR platform is EUR 460 000,00 and the maximum target is EUR 560 000.00.

Pledge on the portfolio is held by CROWDESTOR OU as well as 40% ownership by CROWDESTOR SECURITY AGENT LLC of the legal entity owning the portfolio throughout the duration of the project.

Max. target: EUR 560 000

Min. target: EUR 460 000

Loan term: 12 months

Interest rate: 24% per annum

Interest payments: paid monthly

Loan repayment: monthly including partial principal payment with final repayment at the end of the Loan Term

Crowdestor.eu BuyBack fund: Yes

Security:

Remember - interest rate payments start calculating from the day you make your investment!

Until recently, Georgia was one of the largest markets for payday loan companies. Due to stringent regulatory measures, many companies are leaving Georgian market and disposing of their loan portfolios by selling them at considerable discounts.

This projects seaks to finance consumer installment loan portfolio acquisition, management and recovery. The portfolio is only 20% delinquent and was up for sale because of the originator company’s decision to exit the market due to tightening regulations on issuance of consumer loans, which has no effect on already issued portfolio.

Loan portfolio consist of 6486 issued loans out of which 67% are customers with no delay, 13% with delayed payments of less than 90 days and 20% with delays up to 220 days.

The total open debt portfolio as of October 24th is 1 588 983 EUR.

Portfolio performance projected scenarios (cumulative in EUR)

Bachana’s expertise in managing consumer lending business and debt collection spans over a period of 10 years. He has worked in two major financial organizations - Bank of Georgia and Twino. During his employment at Twino he held several roles over the past 6 years - including Head of Debt Collection and Customer Care, and Regional Country Manager for Georgia and Kazakhstan.

More detailed information about Bachana’s experience you can find here: https://www.linkedin.com/in/bachana-rapava-238320157/

https://www.financialbureau.ge/en

The partner company is run by a team of highly experienced management in the field of debt collection and loan portfolio management. It was founded in 2015, with the goal to serve major microfinance organizations and banks on the Georgian market. Over the past 5 years the company has seen a very rapid growth which was driven by exceptional results of loan portfolio management, consolidating trust among organization’s clients and their debtors, with the status of a mediator, as well as promoting core strengths in problem asset management, and offering full extent of legal collection services.

The Financial Bureau also carries out investments in problematic loan portfolio assets. Furthermore, it aims for transparency and acts within the legal framework of the market, with reputation stipulated by the highest standards.

With their own and international multi-year expertise, the Financial Bureau management team has developed an effective problem asset management system which covers all stages of loan processing, while corresponding to all modern tools and tac. Moreover, it protects both - the company and the borrower interests.

Information about services: https://www.financialbureau.ge/en/services

Clients: Bank of Georgia, Vivus.ge (4Finance Group), Netcredit.ge (Twino), Lendo.ge, Mogo.ge, Moneza.ge, Mycredit.ge, Credia.ge, Mon.ge, Wandoo.ge and others.

Staff: 500+ employees

Locations: 20 branches all over Georgia

Volume: currently processing more than 100 000 cases

According to the National Statistics Office of Georgia, population in Georgia is 3,723,000. GDP per capita (at current prices), 1081 USD. Money supply (M3), 21.1 billion Gel. Foreign Direct Investments in 2018 was 1 265 Million USD. External Trade Turnover period 2019 JAN-SEP was 9 193 Million USD.

As of October 2019, the loan portfolio of commercial banks was GEL 30.4 billion, from which GEL 13.6 billion were loans denominated in national currency and loans in foreign currency was 16.7 billion.

Annual growth of GDP in the second quarter of 2019 was 4.5%, with an 8-month average growth of 5%, according to preliminary data. These figures are in line with the forecasts of the National Bank so far. In particular, despite recent risks, relatively high economic growth during 2019 was largely driven by increased external demand. According to the figures for 2018, Georgia's GDP was 41 billion GEL.

According to Georgia National Bank Forecast of real GDP growth is expected for 2019-2020. Economic growth in 2019 will be more than 4.5%.

Doing Business 2020, a World Bank Group flagship publication of annual studies measuring the regulations that enhance business activity and those that constrain it. Doing Business presents quantitative indicators on business regulations and the protection of property rights that can be compared across 190 country economies.

Georgia has advanced in the Doing Business rankings and moved to seventh place. Ratings include different criteria. Georgia has the best results in the criterion of minority shareholder protection and is ranked second in the world. Georgia ranks fourth in the world in terms of starting a business. Georgia also ranks fourth in property registration criteria.

What is the essence of this transaction?

Current portfolio owner is selling portfolio to newly established LLC Nomo, which is the borrower. Borrower acquires the portfolio at a discount and continues to manage it and collect repayments with the cooperation of the largest debt collection agency in the market.

Why it is financially profitable for LLC Nomo to pay 24% annual interest rate?

Planned ROI for the portfolio acquired at the agreed price is 94% over a period of 2 years, enabling borrower to repay the initial investment by monthly partial principal payments within first 12 months of collection initiation.

What happens if LLC Nomo fails to pay interest and/or principal payment?

If LLC Nomo delays interest payment and partial principal payment for more than 30 days, pledge will be realized and loan assets will be auctioned by CROUDESTOR SECURITY AGENT.

What is the legal mechanism how Borrower takes over liabilities and pledges from the current senior lender?

Based on cession agreement which is signed between Borrower LLC Nomo and original portfolio issuer LLC BRS.

Are the deal documents signed already?

Yes, Cession agreement is signed.

¡Apúntate para estar al día de las últimas inversiones y ofertas especiales!